Group topline

(in millions of euros)

| 1H22

| 1H21

| 1H20

| 1H19

| Change 1H22 vs 1H21

|

Orders

| 509.2

| 465.6

| 398.7

| 533.8

| +9%

|

Sales

| 472.6

| 366.0

| 407.2

| 496.4

| +29%

|

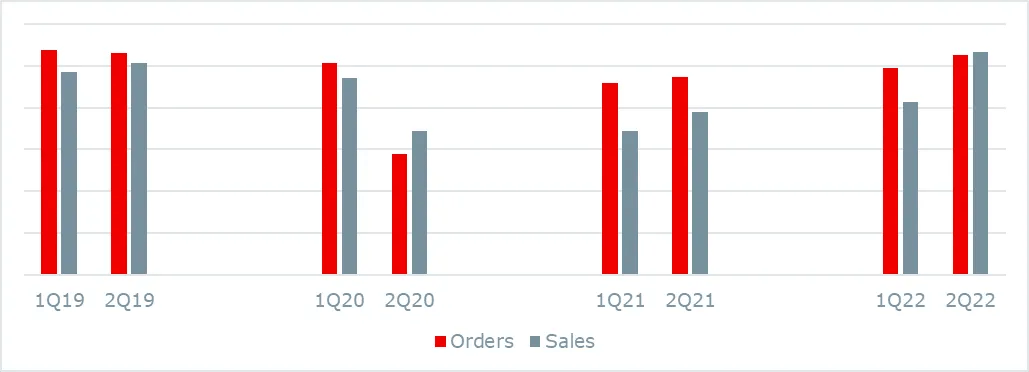

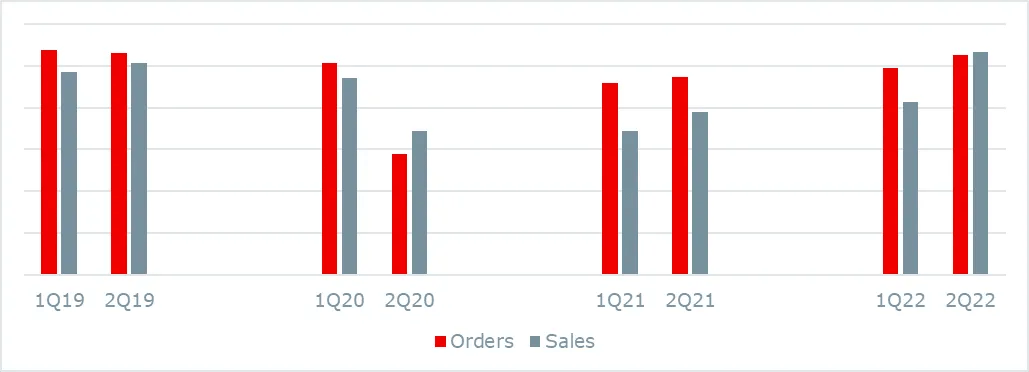

1H quarter-by-quarter overview

Group topline – continued solid order intake with sales conversion improving

Barco’s first half sales were 29% above 1H21 and 8% above 2H21 with sales conversion improving in all divisions and all regions. During the first semester, growth accelerated from the first to the second quarter and sales for 2Q22 surpassed 2Q19 pre-pandemic levels, driven by strong uptakes in demand in Cinema and Meeting experience.

Order intake continued to grow, increasing 9% versus last year, and orderbook, which increased 146 million euro compared to last year’s first semester and 51 million euro compared to year-end 2021, reached a new record level of 538 million euro after six consecutive quarters of positive book-to-bill.

Division topline performance; Sales increase 37% in 2Q and 29% in 1H22 on growth across all business units

The Entertainment division delivered double digit gains in both orders and sales year over year, despite the negative impacts of continued component shortages and regional lockdowns in China. Most of the growth came from the Americas reflecting revived demand for renewal projectors. In addition, Immersive Experience saw a continued good level of order intake resulting in healthy double-digit sales growth.

Enterprise delivered a strong first semester including second quarter sales equaling 2Q19. Reflecting stabilizing back-to-office conditions in Europe and the Americas, the Meeting Experience saw a +50% increase for the first semester and 2Q sales that were above 2Q19. Large Videowalls sales for the first half grew at a double-digit rate versus last year and were flat in the second quarter compared to 2Q19.

While order intake in Healthcare decreased slightly from last year’s spike, orders remained very solid reflecting the ongoing resumption of spending by customers in the diagnostic imaging and surgical markets and resulted a positive book-to-bill ratio for the third consecutive semester. With solid deliveries in all three regions, Healthcare reported sales growth in both segments for a divisional gain of more than 20% and an all-time high semester sales performance.

EBITDA starts to expand

EBITDA was 46.2 million euro up from 27.5 million euro a year ago. EBITDA margin was 9.8% of sales, or 2.3 percentage points better than 1H21 and 2.7 percentage point higher than 2H21.

Gross profit margin was 37.9%, an improvement of 1.2 percentage points versus the first semester of last year and 2.9 percentage points versus the second semester of last year, mainly reflecting favourable product mix.

Free cash flow for 1H22 was negative 28 million euro compared to positive 35 million euro last year, mainly due to higher inventory in response to the supply chain constraints and higher receivables due to a surge in sales toward the end of the quarter.

Quote of the CEO's, An Steegen & Charles Beauduin

“Barco is turning the corner in its recovery from the pandemic. Strong demand for our product solutions drove sales to exceed pre-pandemic levels in the second quarter, supported by a focused organizational structure.

For the second semester we are well prepared to deliver steady sales growth and further improve margins on product mix and operational improvements.”

Outlook 2022 - current

The following statements are forward looking, and actual results may differ materially.

Assuming economic conditions and supply chain constraints do not further deteriorate and orders to sales conversion continues to improve in the second half of the year, management expects that sales for the year 2022 will increase approximately 25% compared to 2021, with an EBITDA margin between 10 to 12%.